buy cheap norvasc canada no prescription

Despite the pandemic, internists have managed to gain some ground in the wealth department over the past year, amoxicillin and cold and flu medicine a Medscape survey shows.

More internists are worth $1 million to $5 million in 2021, compared with last year (42% vs. 37%), more are worth over $5 million (6% vs. 5%), and fewer internists are worth less than $1 million (52% vs. 58%), according to Medscape’s annual wealth and debt report.

“The rise in home prices is certainly a factor,” Joel Greenwald, MD, CFP, a wealth management adviser for physicians, said in an interview.

“Definitely the rise in the stock market played a large role; the S&P 500 finished the year up over 18%. Finally, I’ve seen clients … cut back on spending because they were worried about big declines in income and also because there was simply less to spend money on,” said Greenwald of St. Louis Park, Minn.

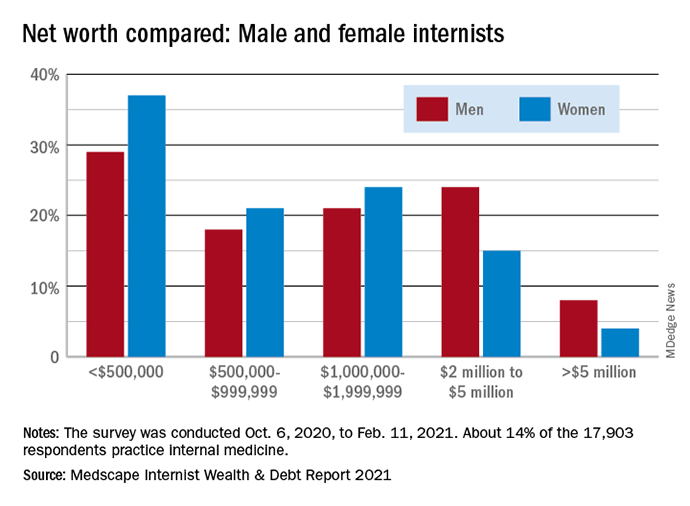

Wealth Disparities Between Male and Female Internists

The wealth disparities that exist among internists get somewhat realigned, however, when viewed through the lens of physician gender. The higher-worth segments of the specialty skew rather heavily male: 8% of male internists are worth over $5 million versus 4% of females, and 24% of men are worth $2 million to $5 million but only 15% of women, based on data from the 14% of survey respondents (n = 17,903) who practice internal medicine.

Zooming out from the world of internal medicine to the universe of all physicians shows that internists are closer to allergists and immunologists than to dermatologists when it comes to share of practitioners with net worth over $5 million. That macro view puts allergy/immunology at 2%, internal medicine at 6%, and dermatology at 28%. Meanwhile, internists’ 33% share of those worth under $500,000 is lower than family medicine’s 40% but higher than oncologists’ 16%.

Medical School and Other Debt

Continuing the comparison with all specialties, internists are doing somewhat better at paying off school loans. Among those responding to the survey, 20% are still paying off their medical school debt, closer to the low of 12% for infectious disease specialists than the high of 33% for the emergency physicians, according to the Medscape report.

Larger proportions of internists are paying off credit card debt (26%), car loans (35%), and mortgages on primary residences (61%), while 13% said that they are not paying off debts. Nonpayment of those debts was an issue for 11% of internists who said that they missed payments on mortgages or other bills because of the COVID pandemic.

Almost all internists said that they live either within (50%) or below (44%) their means, Medscape reported.

“There are certainly folks who believe that as long as they pay off their credit card each month and contribute to their 401(k) enough to get their employer match, they’re doing okay,” Greenwald said. “I would say that living within one’s means is having a 3- to 6-months emergency fund; saving at least 20% of gross income toward retirement; adequately funding 529 college accounts; and, for younger docs, paying down high-interest-rate debt at a good clip.”

This article originally appeared on MDedge.com, part of the Medscape Professional Network.

Source: Read Full Article